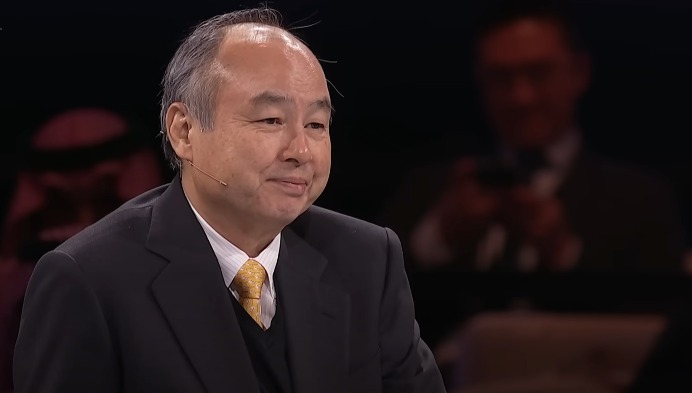

With a staggering net worth of $28 billion, Masayoshi Son, the clever founder and CEO of SoftBank Group, has established himself as one of the most powerful people in the world of technology and finance. His extraordinary wealth is not the result of chance. Rather, it is the outcome of decades of measured risks, wise investments, and a remarkable aptitude for identifying technological trends well in advance of their mainstreaming. Son has established himself as a leader in based on technology transformation thanks to his investments and business choices, which have drastically changed industries.

Son’s investment approach expanded in tandem with SoftBank. He established the $100 billion Vision Fund in 2017 to support rapidly expanding companies in the fields of artificial intelligence, robotics, and telecommunications. SoftBank was able to finance businesses like Uber, DoorDash, and Fanatics companies that would go on to become significant players in their respective industries—through the Vision Fund, which was made possible by large investments from the Public Investment Fund of Saudi Arabia. This strategy not only increased Son’s wealth but also made SoftBank a major force in reshaping the tech sector and impacting global industries.

| Personal Information | Details |

|---|---|

| Name | Masayoshi Son |

| Date of Birth | August 11, 1957 |

| Age | 67 years |

| Place of Birth | Tosu, Saga, Japan |

| Education | University of California, Berkeley (1980) |

| Nationality | Japanese |

| Spouse | Masami Ohno (m. 1979) |

| Occupation | Entrepreneur, Investor, Technology Executive |

| Known For | Founder & CEO of SoftBank Group |

| Net Worth | Estimated $13.7 Billion (as of 2025) |

Son has made substantial forays into real estate along with to his tech investments. His $117.5 million purchase of a lavish estate in Woodside, California, which was among the most expensive homes ever sold in the state, garnered media attention in 2012. His 2013 acquisition of the Tiffany building in Tokyo, which cost $326 million, added valuable properties to his portfolio. These real estate endeavors reveal Son’s varied strategy for accumulating wealth, which looks for assets with both prestige and long-term worth.

Even though Son has had success with many of his investments, he has also had failures. SoftBank’s investment in WeWork, a co-working startup that was predicted to grow into a global powerhouse but failed following a disastrous initial public offering (IPO) in 2019, was the most noteworthy of these. WeWork’s public debut collapse garnered a lot of media attention and scrutiny, and Son’s investment choices were heavily criticized. Son’s wider portfolio, however, flourished despite the hardship, demonstrating his adaptability and resilience when needed.

Additionally, Son has advanced significantly in the field of artificial intelligence (AI). A further indication of his forward-thinking approach to technology investments was his announcement in 2025 of a joint venture with OpenAI to introduce AI services to Japan. His dedication to AI is a component of a broader plan to secure SoftBank’s position at the vanguard of upcoming technological advancements, guaranteeing the company’s competitiveness in a constantly changing market. Son is positioned as a pivotal figure in the development of cutting-edge technologies, and his involvement with AI is expected to have an impact on industries worldwide.

Masayoshi Son will hold 29% of SoftBank by 2025, making him the largest shareholder in the business. His 420,000 shares have made a substantial contribution to his wealth, and his financial clout is only going to grow as SoftBank keeps making investments in game-changing technologies. From e-commerce and artificial intelligence to real estate and telecommunications, Son’s vision and investments have had a long-lasting impact on a variety of industries outside of SoftBank. His success stems from more than just his financial acumen; it also stems from his visionary leadership and ability to predict trends.

The $28 billion in Son’s net worth is more than just a personal achievement. It demonstrates the enormous impact he has had on business, finance, and technology. He has radically changed sectors and industries through his identification and investment in disruptive technologies. Son’s wealth, which includes investments in Alibaba, AI, and other ventures, is a legacy of revolutionary change rather than just the result of astute financial decisions. As his businesses continue to expand and change, his story demonstrates how visionary leadership can transform sectors and spur new ideas.